Understanding the challenges and with a focus on supporting businesses within their geographical areas, the two BIDs have been developing and delivering projects and services to encourage spend within the city. Christmas projects including new Christmas lights and a new Love Bristol Night Out Gift Card will help attract people into the city across the festive season and bring money back into the night-time economy both across Christmas and into the New Year. The gift card is a great way for businesses to reward their staff at Christmas and beyond.

BID Updates - Press Releases

City centre BIDs release economic data for businesses in Q3 2022

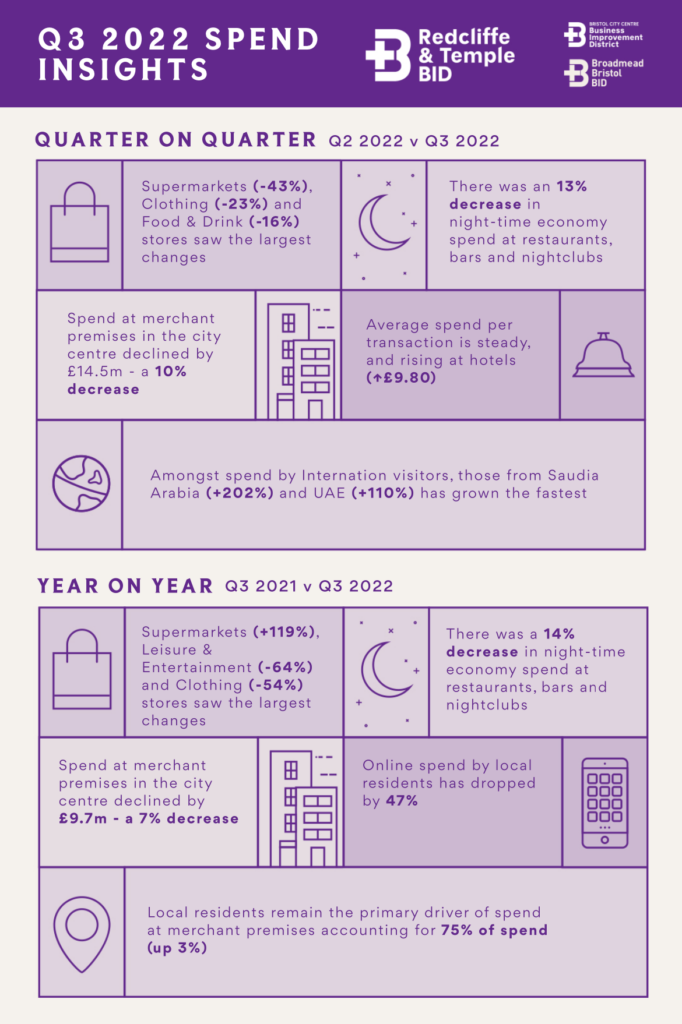

New data released shows how Bristol city centre businesses have been impacted by cost-of-living crisis and inflation across the Q3 trading period.

21/11/2022

Bristol’s city centre businesses have experienced a decline in sales and revenue for Q3 of 2022, confirmed by the latest new data released by Bristol City Centre BID and Redcliffe & Temple BID.

It was a positive start to the year with signs of recovery for city centre businesses from January to June, retailers, hotels, food and drink businesses and clothing outlets all benefited from increased spend across the first half of the year. However, Q3 data shows the impact of the cost-of-living crisis, increased inflation rate and rising cost of goods, and how it has affected consumer spend in the city’s businesses.

The latest data has confirmed a total ‘in premises’ Visa spend of £128.1m across businesses in the BS1, BS2 and BS8 postcodes for Q3, July – September 2022. This is a reduction of £14.5 million in comparison to Q2, April – June 2022. The data also offers an analysis of different merchant category groups for each quarter and then a comparison for each, quarter by quarter.

This insight enables the BIDs to understand how businesses and different sectors are performing and how people are choosing to shop, eat, drink and experience the city centre. Whilst the first half of the year showed some positive signs of recovery, there were expectations that Q3 data would reflect the current economic landscape facing the UK.

Steve Bluff, Head of Redcliffe & Temple BID

We knew at the end of Q2 that there were significant business challenges ahead, our conversations with business owners at that time highlighted impact on their profits and the concerns for Q3. Our data shows that businesses have taken a hit in Q3 and it is important that we develop projects and services to help support them in the coming months. We have a big focus on Christmas this year and supporting a good trading period, by attracting people into the city to spend time and support local businesses.Whilst most sectors have been impacted, a positive sign from the data is that hotels and accommodation in the city centre have remained stable between Q2 and Q3 2022. There is also increased international spend in the city from Saudi Arabia and the UAE, and spend from the USA and the Republic of Ireland has remained strong in the city centre, showing the attraction of international visitors is benefitting the city.

A new cost saving service for businesses in the BID areas has also recently launched, offering specialist advice and support to identify savings on utility bills. The service is free of charge to access and is already helping businesses to cut costs during these challenging times.

Vicky Lee, Head of Bristol City Centre BID

Our role as a BID is to support businesses through the challenging economic landscape which we know is changing the spending habits of people in the city. Our programme of projects and events, both current and in the future, is focused on attracting visitors into Bristol city centre and encouraging them to shop local across the festive period and into the New Year. We are focused on driving footfall into businesses during the start of next year with events planned across January, February and March including the return of Bristol Light Festival in early February 2023 which with a longer duration will be encouraging people from outside of the city to visit.SPEND BY SECTOR

Sector |

Q3 spend |

Q2 spend |

% increase / decrease Q3 vs Q2 |

Restaurants, pubs and clubs |

£35million | £39million | – 10% |

Clothing |

£20million | £26million | – 23% |

Supermarkets |

£10million | £17million | – 43% |

General retail & high street |

£13million | £14million | – 9% |

Hotels & accommodation |

£9million | £9million | + 2% |

Working with Movement Insights, a data insights company, the BIDs plan to analyse quarterly data for the city centre business economy to gather and compare the city’s economic progress, enabling the BIDs to further support businesses through the economic landscape.